how much does a property tax lawyer cost

How much does it cost to probate a will in Nova Scotia. It is important to note that some attorneys charge well above this average up to as much.

- Answered by a verified Lawyer.

. Let us look at the. If your home is over a certain value often over 900000 In exceptionally complex circumstances unlikely to be the case for young buyers there may be significant additional costs but if you. Those are averages across the.

872 from Consolidated Public Statutes Statutes of Nova ScotiaNova Scotia Probate Fees. How Much Does a Tax Lawyer Cost. Some lawyers bill by the hour for their work while others quote a flat fee rate contingency rate or use retainer fees.

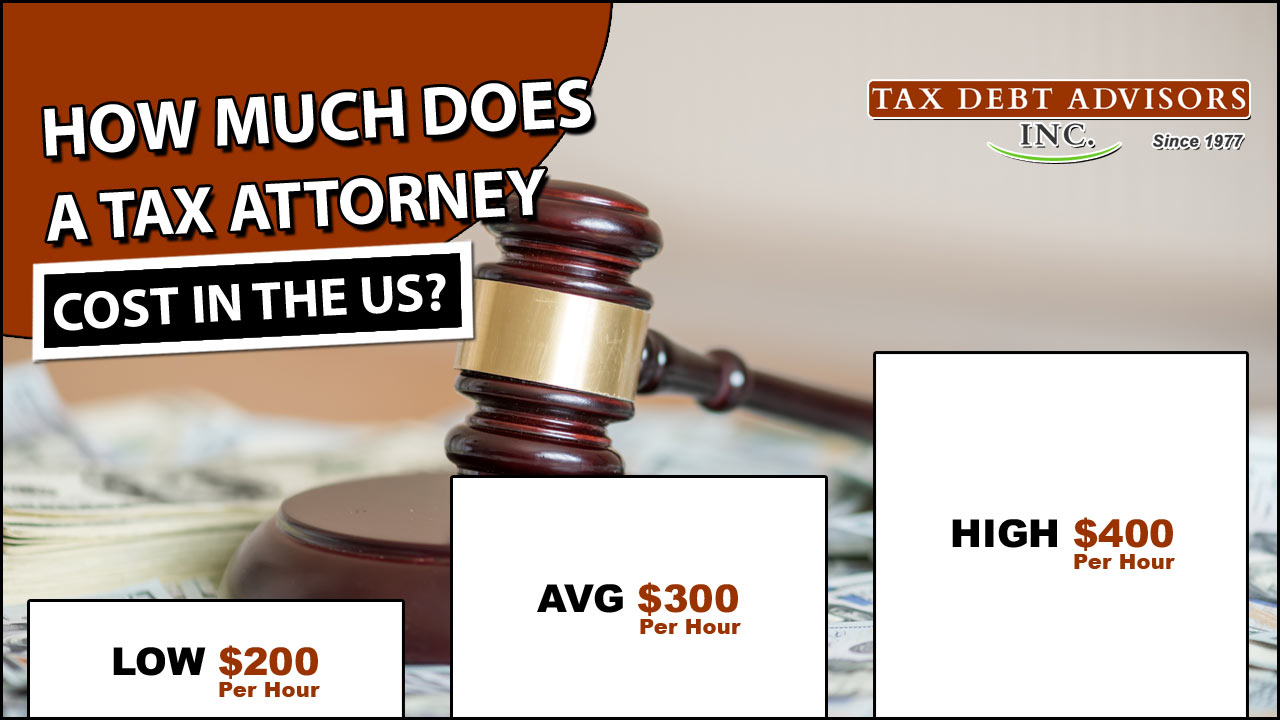

How Much Does a Probate Lawyer Cost in Texas. The cost of a probate lawyer varies depending on the complexity of the estate and the lawyers experience. Nov 6 2019 on average a tax attorney costs about 300 per hour with average tax lawyer fees ranging from 200 to 400 in the us for 2019.

For many other sorts of cases particularly tax issues an hourly fee is a typical approach to charge. Heres a very simple breakdown of the average prices that tax attorneys charge for common tax services whether hourly or as a flat fee. The cost of your tax attorney will be based on the reason why you need a tax lawyer type of case the level of experience your attorney has and more.

Heres a quick breakdown of the average prices tax attorneys charge for common tax services hourly or flat fee. Others set fees that are equal to a certain percentage of the value of the property being probated such as 4 of the first 100000 then 3 of the next 100000. This fee can vary depending on the lawyers experience and the type of case you are pursuing.

After figuring out the cost of hiring a tax lawyer you should also know about the types of tax attorney fees. A lawyers hourly rate varies drastically based on experience location operating. For example if the.

How much does a tax lawyer cost. Based on ContractsCounsels marketplace data the. Typical Cost of Hiring a Tax Attorney.

The average cost to hire a lawyer in the Philippines is around 1500-2000. Many of the lawyers in our study reported a range of fees with minimum and maximum rates that averaged 295 and 390 respectively. Hourly fees for tax attorneys range from under 200 to over 450 per hour depending on a firms reputation a lawyers experience and other factors such as geographic location.

I entered into a lease for commercial space May 2009 and just recieved a bill for additional operating costs. For standard commercial closings on small multi-family properties a real estate attorney may cost 1500 2500. Notably some lawyers charge far more than this average often up to 1000 per hour.

The most basic lawyer might charge as little as 60 per hour but its much more common for attorneys to charge 150 to 200 per hour for standard services. The client and lawyer will agree on the hourly rate before getting started with the case. How much does a property tax lawyer cost.

For large complex transactions a real estate attorney may cost 3000. Typically there are two types of tax lawyer fees. To negotiate small agreements with the IRS you can pay from 700 to 1500.

For simple cases that require only a modest amount of legal representation you can pay 2000 to. A lawyer often charges between 100 and 400 per hour for their services. The average hourly cost for the services of a lawyer ranges from 100 to 400 per hour.

Although each tax attorney will charge their own hourly rate you can expect to pay anywhere between 200 and 400 per hour. Although each tax attorney will.

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Top Reasons You Would Need To Hire A Property Tax Dispute Lawyer

Criminal Defense Lawyer Cost 2020 Average Attorney Fees

Tax Attorney Cost Tax Debt Advisors

To Cut Taxes Big Box Stores Use Dark Store Theory Bloomberg

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

What To Do When Your Property Tax Bill Increases

Top 5 Property Tax Firms In South Florida Luxury Property Care

Everything You Need To Know About A Tax Attorney Turbotax Tax Tips Videos

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Publication 530 2021 Tax Information For Homeowners Internal Revenue Service

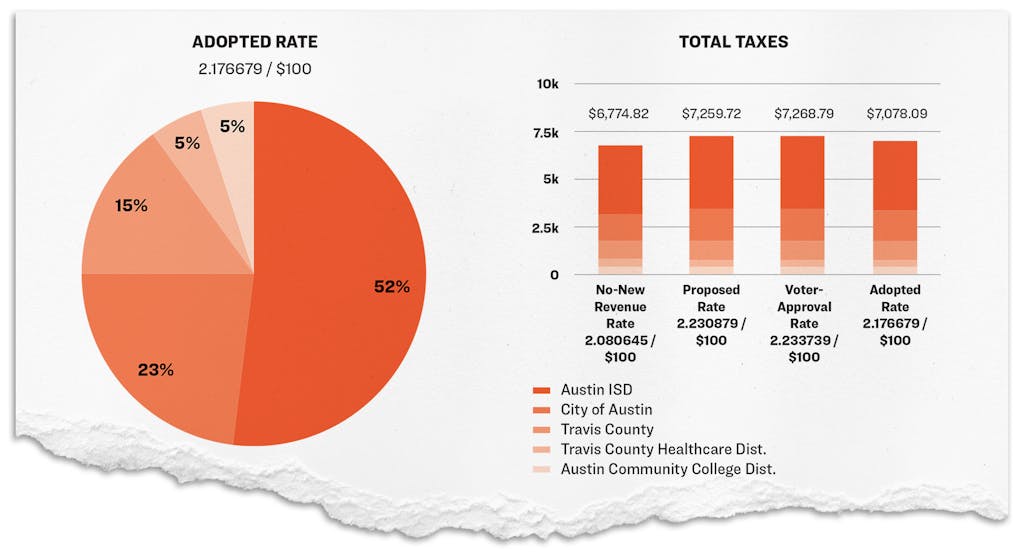

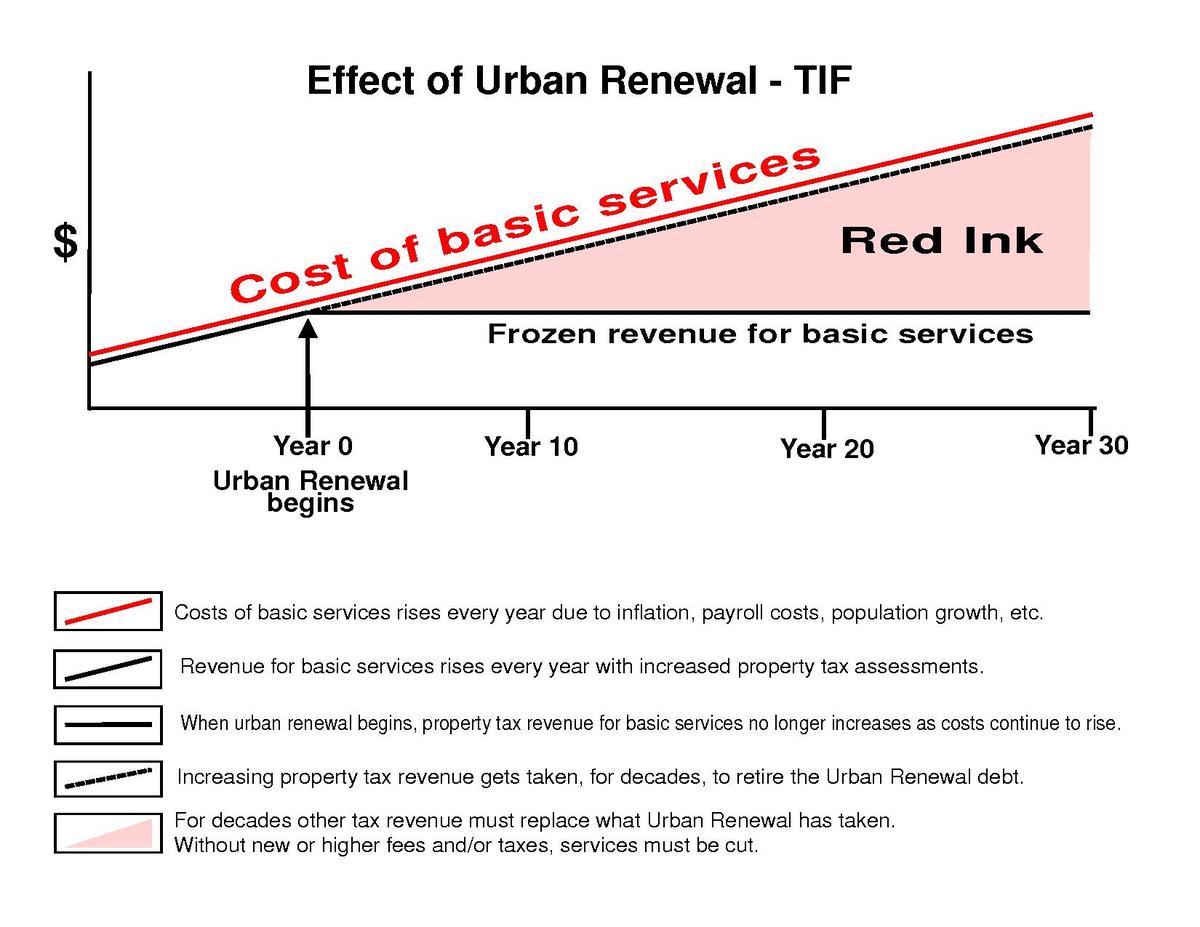

Tax Increment Financing Wikipedia

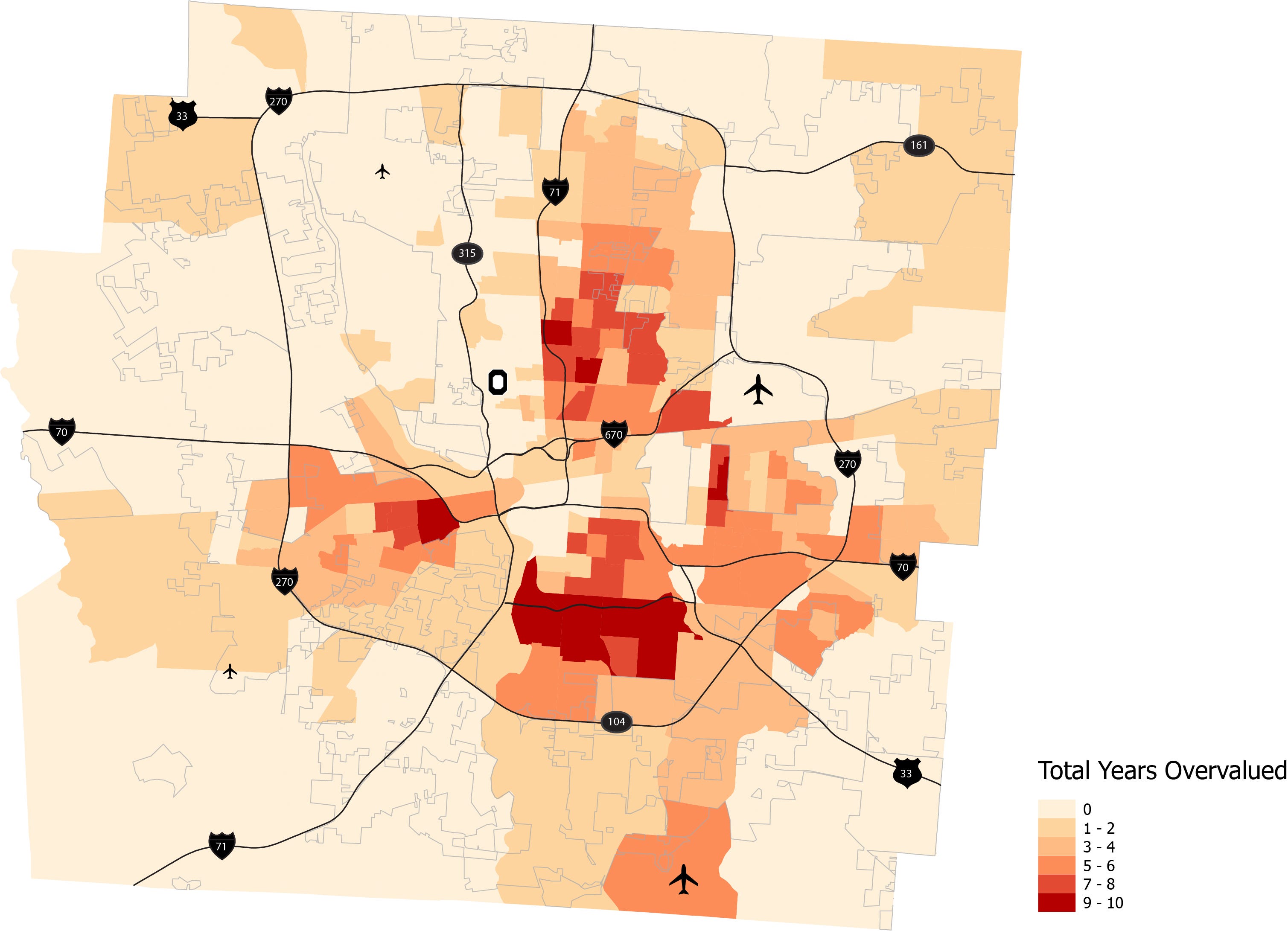

Franklin County Real Estate Taxes Overvalued Poor Black Neighborhoods

Is A Real Estate Attorney Required In New Jersey

.png)

Your Assessment Notice And Tax Bill Cook County Assessor S Office

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Californians Adapting To New Property Tax Rules City National Bank